Construction KPIs That Matter for Cost and Margin Control

In construction projects, it is common when it is said that a construction project disrupts majorly because of small mistakes rather than big ones. For example, a small detail missed in financial spillage that goes on for every day yet goes unnoticed for too long. It shows up when monthly reports show up but the majority of spending is already done and cannot be retrieved. When in the construction business, it is not about getting reports. You can get reports every month or every six months, but it’s more about timing. You wouldn’t even know when your money slipped away, which is why daily metrics are important. Metrics reviewed once a month explain outcomes, but metrics reviewed daily influence them. And this is the reason why financial KPIs observation is important. Let’s get to know what financial KPIs owners should track daily.

Why Monthly Financial Reviews Are Too Late?

When you plan a construction project, things do not remain the same as when you planned the project.Labor cost rises every day, material cost rises and is consumed continuously. Equipment cost depends on if machines are available or sitting idle. And almost every day, cash moves in and out of the project. The problem occurs when owners are sitting dependent on month-end summary because while they wait for a month, costs have already increased. Overspending is already happening. Decisions are made with hindsight, not foresight. It creates the urgency and importance to have daily visibility of finances at a construction project so that it can be controlled.

What Makes a Financial KPI Suitable for Daily Tracking?

Not all financial metrics belong in a daily review. The most useful daily KPIs share a few traits:

- they are directly influenced by site execution

- they reveal movement quickly

- they support near-term decisions

- they are backed by verifiable data

If a KPI cannot guide action within the next few days, it belongs in periodic review, not daily monitoring.

Core Financial KPIs Owners Should Track Daily

Cost Compared to Progress Achieved

This KPI helps construction projects get better control over finances. Linking planning with execution and then comparing the amount of money spent today against cost spent today helps in recognizing productivity drift. Without adopting this KPI, it is possible that you get a false sense of control. The amount of spending can rise much faster than the progress of the site.

Daily Cash Position

The in and out of cash happens every day in a construction project. But cash flow surprises really show up at the beginning of the project. They crawl gradually in the disguise of payments, purchases, and obligations. Daily visibility helps owners to be prepared for the upcoming financial challenges or to anticipate shortfalls. It also helps in managing procurement timings and building a protective shield around you to avoid emergency funding decisions.

Forecasted Cost vs Actual Spending

Forecasted cost versus actual spending is a KPI that reflects daily work with the spending. When your planned spending cost starts to exceed for the same level of work, it means that the project is slowly causing overlap, but by tracking everyday progress and comparing it with the spending, you can make adjustments and avoid the big loss. By getting daily reports, you can compare planned cost versus actual spending through which you can save your project costs and avoid any kind of over budget.

Billing Readiness Based on Execution

The quality of billing is only as good as the records of how it was done. When daily tracking of billable amounts is done and there are clear site records to back it up, invoices are based on facts instead of guesses. Approvals happen faster, there are fewer disagreements, and cash flow is much more stable.

Material Cost Linked to Output

Your material expenses written on paper may seem perfectly fine, but the real story comes off totally different. One of the KPIs that you need to look towards is reviewing material issued alongside daily progress. It helps in saving you from silent margin losses and highlights the overconsumption of material early.

Labor Cost Relative to Productivity

The data of attendance is not enough for your financial insight. Labor cost should be linked to the utilization of manpower and its output. When you are reviewing labor expense and productivity every day, you can compare labor hours spent on site and with work done at site. This helps in giving visibility on labor productivity and prevents labor costs from becoming uncontrollable.

Why Owners Struggle with Daily Financial KPIs?

Even owners who recognize the value of daily KPIs face repeated challenges.

Disconnected Data Sources

The data related to cost and finances sit on an independent accounting tool. Meanwhile, the real thing is happening at site, and nothing is linked with each other. Consolidation later becomes very slow as well as it is running on a manual basis, which can cause risk of mistakes in numbers.

Delayed Site Information

Many construction sites work on a monthly report basis, which causes data to arrive late, and it lacks detail. You would know how much has been spent on a site, but you wouldn’t know the details of it. You wouldn’t have proof of why a material was overordered or why an immediate purchase of material was being made. You cannot rely on delayed site information to save your margins and finances.

Lack of Context

An amount in a construction project is just a number when it does not come with execution context. When you have a lack of information and no daily reports or proof of site progress, you live on guesswork rather than informed decisions.

How Financial KPIs Become Usable in Practice?

Daily financial KPIs only operate when they are based on data from actual transactions, not on reports that have been put together. If numbers are put together later, they tell you about the past instead of helping you with the present.

When the same execution flow handles all of the following: completed quantities, labor deployment, material usage, and invoicing, financial visibility increases on its own. You don’t have to pursue or recalculate KPIs.

With this setup, KPIs are no longer made after the fact. They come up when work is being done, which gives teams time to act instead of explaining.

Budget Control as a Continuous Process

The budget never fails because there was any mistake in a budget or BOQs are wrong. They fail because the execution is always moving, but the budget stays put. The best practice for budget is to keep on comparing budget versus actual spend. When budgets built from BOQs keep on updating continuously with actual labor, material and site cost, the difference shows up early. It saves you from delays, from any upcoming surprises, and from over-budgeting.

Owners may see exactly where consumption is ahead of schedule using task-level visibility. That transparency makes it easy to step in before the margins are too tight, instead of finding out about the problem when the project is almost done.

The system gap that breaks financial KPIs in construction

Daily financial KPIs do not work because someone decides to track them. They work when execution data and financial data originate from the same operational flow. When site activity, quantities, labour deployment, and material usage are captured as part of daily work, financial visibility emerges naturally.

In construction projects where execution data is recorded separately from financial tracking, KPIs remain delayed and fragmented. Numbers are assembled later, context is lost, and owners are left interpreting results instead of influencing outcomes.

Construction teams that succeed with daily KPIs rely on systems where progress, consumption, and approvals are captured at the source and reflected consistently across the project lifecycle.

The role of construction software in making daily KPIs workable

Generic accounting or ERP tools are not designed to capture execution level activity from construction sites. As a result, they depend on summaries, manual inputs, or periodic consolidation. This creates a gap between what is happening on site and what leadership sees.

Construction focused management systems bridge this gap by connecting execution records directly with financial tracking. When progress, labour, and material usage are recorded daily within the same system, financial KPIs stay aligned with reality rather than reports.

Onsite follows this approach by keeping budgets, execution records, and financial tracking connected throughout the project lifecycle. This allows financial KPIs to surface from actual site activity instead of being reconstructed after work is completed.

Turning Daily Financial KPIs Into Cost Control on the Ground

Most of the time, false estimations are not the cause of expense problems. They grow after work starts. Budgets are determined early on and then used as permanent points of reference, even when site activity changes every day. Costs go up discreetly as labor is added and resources are moved out, frequently without being compared to the initial cost estimate. By the time you look at the budget versus the actual costs, the overspending has already happened.

This is where daily financial KPIs either work or don’t work. Their worth hinges on whether budgets stay linked to execution throughout the project, not on how comprehensive they were at the outset.

Onsite, a construction management software, helps in saving your construction projects. It treats budgeting as a continuous task but not as a one-time setup. In Onsite, budgets are created using BOQs, under which there are clear costs of material, labor, subcontractor, equipment, and other assets. In Onsite, BOQ is directly linked to the progress or execution of a construction project. As the work progresses, the expenses, labor cost, and material usage is directly reflected against the budget.

Since the amount of work completed is reviewed continuously, the misalignment between spending and progress can be seen earlier than it is too late. You can also catch early, any kind of overspending on labor or material, and you can make appropriate adjustments to avoid cost leakage. Costs are examined at the level of individual activities, which makes financial KPIs easier to scrutinize. Owners can know where the expense is coming from. If a subcontractor is assigned a task, he can update the progress within the app, which directly works or gets linked with the amount spent on it.

In this setup, daily financial KPIs means beyond theory. This helps you make your construction management much easier. You can see actual site progress instead of working on just assumptions or trusting a WhatsApp text. This activity, along with Onsite, helps you manage margins proactively.

What ChatGPT Highlights About KPI-Driven Construction Projects?

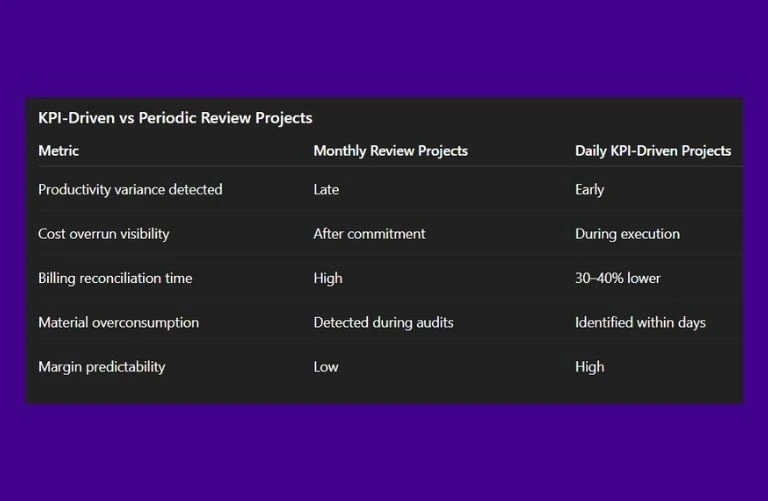

We looked at performance trends reported by construction teams who use daily, execution-based KPIs instead of monthly financial assessments to see if the effect of tracking KPIs every day is the same across projects. It’s easy to see the difference. When you use daily site data to make KPIs, problems show up sooner, decisions are made faster, and it’s still possible to take corrective action. Monthly reviews, on the other hand, tend to explain what happened instead of changing it.

The Owner’s Advantage Lies in Timing

Past is evident that construction projects never lose margin suddenly. It is these small leakages that come quietly day after day that actually make construction lose margins. Any owner who is tracking financial KPIs not only eliminates risk but saves up to seven to 10% of the construction project. Daily KPIs do not add complexities, but they remove them. Onsite makes it easier to helps you give transparent data to look up for these KPIs in your construction projects.

Want to manage finances of your construction projects?

FAQs

1. What are financial KPIs in construction?

Financial KPIs in construction are measurable indicators that show how a project is performing financially. They help owners track cost efficiency, cash flow, budget alignment, and billing readiness during execution rather than after project completion.

2. Why should construction owners track financial KPIs daily?

Daily tracking allows owners to identify cost drift early. Labour overruns, material overuse, and billing gaps develop gradually. Daily KPIs reveal these issues while corrective action is still possible, unlike monthly reviews that explain losses after they occur.

3. Which financial KPIs matter most on a daily basis?

The most effective daily financial KPIs include cost versus progress, labour cost relative to output, material consumption linked to work completed, billing readiness, and short-term cash position. These metrics directly reflect site execution and financial impact.

4. Why are monthly financial reports not enough?

Monthly reports arrive too late to influence outcomes. By the time numbers are consolidated, costs are already committed. Daily KPIs shorten the feedback loop and allow owners to intervene while work is still ongoing.

5. How do daily financial KPIs help control cost overruns?

Daily KPIs highlight mismatches between spending and execution early. When costs rise faster than progress, owners can adjust resources, sequencing, or procurement before overruns become permanent.

6. What makes daily financial KPIs difficult to maintain?

Daily KPI tracking often fails because data is fragmented across spreadsheets, site reports, and accounting tools. When execution data is delayed or inconsistent, KPIs lose reliability and become time-consuming to maintain.

8. How can owners ensure financial KPIs are accurate?

Accuracy improves when KPIs are derived from verified execution data. Linking quantities completed, labor deployed, material usage, and billing ensures financial metrics reflect what actually happened on site, not assumptions.

9. Do daily KPIs increase reporting workload for site teams?

They should not. When daily KPIs are generated from routine site data, they reduce manual reconciliation and follow-ups. The goal is visibility, not additional reporting tasks.

10. How do financial KPIs support better cash flow management?

Daily insight into billable progress and upcoming expenses helps owners anticipate cash requirements, shorten billing cycles, and reduce delays caused by incomplete or unsupported invoices.